Accrual Basis Accounting Requires the Business to Review the Unadjusted Trial Balance

The Adjustment Process

20 Discuss the Adjustment Process and Illustrate Mutual Types of Adjusting Entries

When a company reaches the end of a period, information technology must update sure accounts that have either been left unattended throughout the flow or have not however been recognized. Adjusting entries update accounting records at the terminate of a menstruation for whatever transactions that have not however been recorded. 1 important accounting principle to remember is that just equally the bookkeeping equation (Avails = Liabilities + Possessor'south equity/or common stock/or capital letter) must be equal, it must remain equal after you brand adjusting entries. Too note that in this equation, owner's disinterestedness represents an private possessor (sole proprietorship), mutual stock represents a corporation's owners' interests, and majuscule represents a partnership's owners' interests. We discuss the effects of adjusting entries in greater detail throughout this affiliate.

There are several steps in the accounting wheel that crave the preparation of a trial balance: stride 4, preparing an unadjusted trial balance; step six, preparing an adjusted trial residual; and step 9, preparing a mail service-closing trial balance. You might question the purpose of more than than 1 trial balance. For example, why tin can we not go from the unadjusted trial residual straight into preparing fiscal statements for public consumption? What is the purpose of the adapted trial balance? Does preparing more one trial residue hateful the company fabricated a fault earlier in the accounting cycle? To answer these questions, let'south beginning explore the (unadjusted) trial residual, and why some accounts take wrong balances.

Why Some Accounts Have Wrong Balances on the Trial Residual

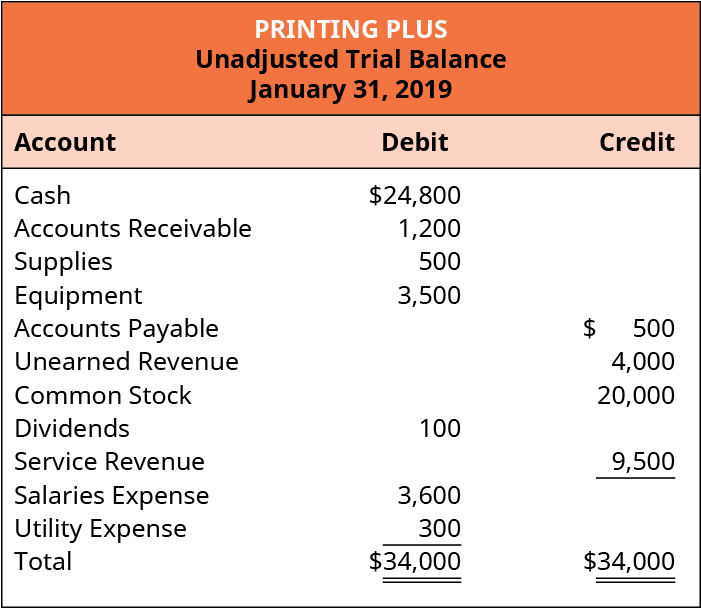

The unadjusted trial rest may have incorrect balances in some accounts. Recall the trial balance from Analyzing and Recording Transactions for the instance company, Printing Plus.

Unadjusted Trial Residual for Press Plus. (attribution: Copyright Rice Academy, OpenStax, under CC BY-NC-SA four.0 license)

The trial remainder for Printing Plus shows Supplies of ?500, which were purchased on January 30. Since this is a new company, Printing Plus would more than likely use some of their supplies right away, before the cease of the calendar month on January 31. Supplies are merely an asset when they are unused. If Printing Plus used some of its supplies immediately on Jan 30, then why is the total ?500 all the same in the supply account on January 31? How do we fix this wrong rest?

Similarly, what about Unearned Revenue? On January ix, the visitor received ?4,000 from a customer for printing services to exist performed. The company recorded this as a liability considering it received payment without providing the service. To clear this liability, the company must perform the service. Assume that equally of January 31 some of the printing services have been provided. Is the full ?4,000 nevertheless a liability? Since a portion of the service was provided, a alter to unearned revenue should occur. The visitor needs to correct this balance in the Unearned Revenue account.

Having incorrect balances in Supplies and in Unearned Acquirement on the company's January 31 trial balance is non due to any error on the company'south part. The company followed all of the correct steps of the accounting cycle up to this point. And so why are the balances still wrong?

Journal entries are recorded when an activity or event occurs that triggers the entry. Usually the trigger is from an original source. Recall that an original source can be a formal document substantiating a transaction, such every bit an invoice, buy order, cancelled check, or employee time sheet. Non every transaction produces an original source document that volition warning the bookkeeper that it is time to make an entry.

When a visitor purchases supplies, the original order, receipt of the supplies, and receipt of the invoice from the vendor will all trigger journal entries. This trigger does not occur when using supplies from the supply closet. Similarly, for unearned revenue, when the company receives an accelerate payment from the customer for services all the same provided, the greenbacks received will trigger a journal entry. When the company provides the press services for the customer, the customer volition non send the visitor a reminder that revenue has now been earned. Situations such every bit these are why businesses demand to brand adjusting entries.

Proceed Calm and Adjust . . .

Elliot Simmons owns a small law firm. He does the accounting himself and uses an accrual basis for bookkeeping. At the finish of his beginning month, he reviews his records and realizes there are a few inaccuracies on this unadjusted trial residual.

One difference is the supplies account; the effigy on newspaper does not match the value of the supplies inventory however bachelor. Some other departure was interest earned from his banking company account. He did not have anything recognizing these earnings.

Why did his unadjusted trial balance have these errors? What can be attributed to the differences in supply figures? What can be attributed to the differences in interest earned?

The Need for Adjusting Entries

Adjusting entries update accounting records at the end of a menstruum for whatever transactions that have non yet been recorded. These entries are necessary to ensure the income argument and balance canvas present the correct, up-to-date numbers. Adjusting entries are also necessary because the initial trial residue may not contain consummate and electric current data due to several factors:

- The inefficiency of recording every unmarried twenty-four hours-to-mean solar day event, such every bit the utilize of supplies.

- Some costs are not recorded during the period just must exist recognized at the end of the catamenia, such as depreciation, hire, and insurance.

- Some items are forthcoming for which original source documents have non nevertheless been received, such every bit a utility bill.

In that location are a few other guidelines that support the demand for adjusting entries.

Guidelines Supporting Adjusting Entries

Several guidelines support the need for adjusting entries:

- Revenue recognition principle: Adjusting entries are necessary considering the acquirement recognition principle requires acquirement recognition when earned, thus the need for an update to unearned revenues.

- Expense recognition (matching) principle: This requires matching expenses incurred to generate the revenues earned, which affects accounts such as insurance expense and supplies expense.

- Time period assumption: This requires useful data be presented in shorter fourth dimension periods such every bit years, quarters, or months. This ways a company must recognize revenues and expenses in the proper flow, requiring adjustment to sure accounts to meet these criteria.

The required adjusting entries depend on what types of transactions the company has, but there are some common types of adjusting entries. Before we look at recording and posting the nearly mutual types of adjusting entries, we briefly discuss the various types of adjusting entries.

Types of Adjusting Entries

Adjusting entries requires updates to specific account types at the cease of the menses. Non all accounts require updates, only those not naturally triggered by an original source document. There are two main types of adjusting entries that we explore further, deferrals and accruals.

Deferrals

Deferrals are prepaid expense and revenue accounts that have delayed recognition until they take been used or earned. This recognition may non occur until the end of a period or future periods. When deferred expenses and revenues have yet to be recognized, their information is stored on the balance sheet. Every bit before long as the expense is incurred and the revenue is earned, the information is transferred from the remainder sheet to the income argument. Two main types of deferrals are prepaid expenses and unearned revenues.

Prepaid Expenses

Recall from Analyzing and Recording Transactions that prepaid expenses (prepayments) are assets for which advanced payment has occurred, before the company tin can do good from employ. As soon equally the asset has provided benefit to the company, the value of the asset used is transferred from the balance sheet to the income statement as an expense. Some common examples of prepaid expenses are supplies, depreciation, insurance, and hire.

When a company purchases supplies, information technology may not use all supplies immediately, just chances are the company has used some of the supplies by the finish of the menses. It is not worth it to record every time someone uses a pencil or piece of paper during the menstruation, and so at the finish of the menstruation, this account needs to be updated for the value of what has been used.

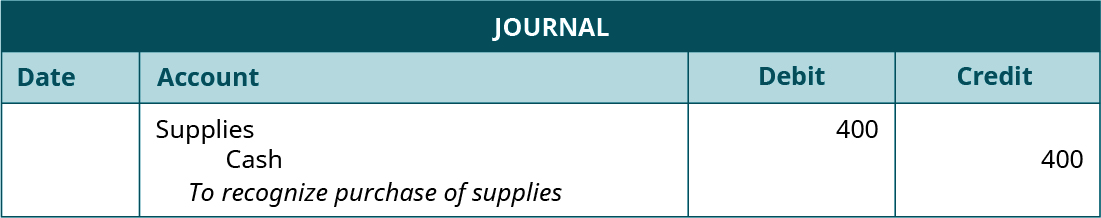

Let'southward say a company paid for supplies with greenbacks in the amount of ?400. At the end of the month, the visitor took an inventory of supplies used and determined the value of those supplies used during the period to be ?150. The following entry occurs for the initial payment.

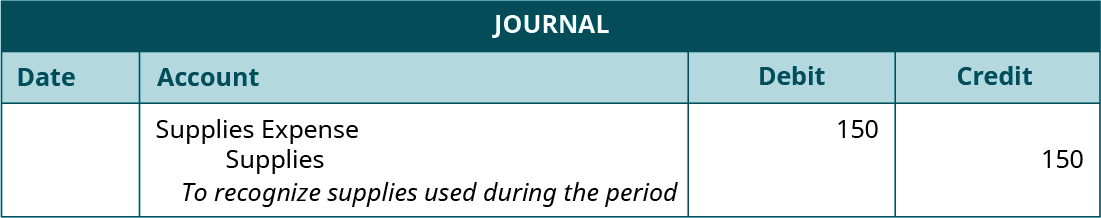

Supplies increases (debit) for ?400, and Cash decreases (credit) for ?400. When the company recognizes the supplies usage, the following adjusting entry occurs.

Supplies Expense is an expense account, increasing (debit) for ?150, and Supplies is an asset account, decreasing (credit) for ?150. This ways ?150 is transferred from the balance canvas (asset) to the income statement (expense). Observe that not all of the supplies are used. At that place is still a residuum of ?250 (400 – 150) in the Supplies business relationship. This amount will behave over to hereafter periods until used. The balances in the Supplies and Supplies Expense accounts evidence as follows.

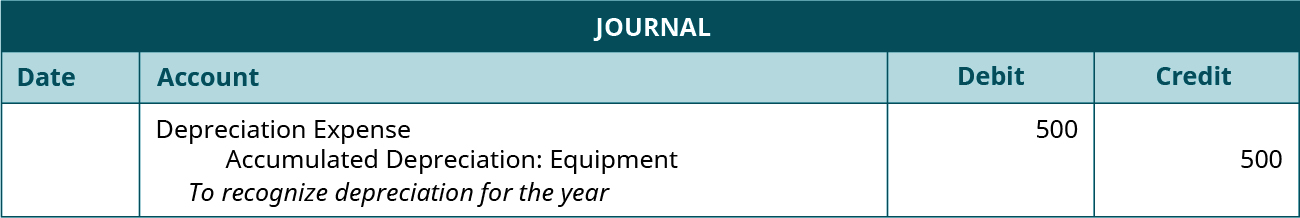

Depreciation may as well require an adjustment at the finish of the period. Think that depreciation is the systematic method to tape the allocation of cost over a given period of certain avails. This allotment of cost is recorded over the useful life of the asset, or the time flow over which an nugget cost is allocated. The allocated cost up to that point is recorded in Accumulated Depreciation, a contra asset business relationship. A contra account is an account paired with some other account type, has an opposite normal remainder to the paired account, and reduces the balance in the paired account at the end of a menstruation.

Accumulated Depreciation is reverse to an asset business relationship, such as Equipment. This ways that the normal residue for Accumulated Depreciation is on the credit side. It houses all depreciation expensed in electric current and prior periods. Accumulated Depreciation will reduce the nugget business relationship for depreciation incurred up to that point. The difference between the asset's value (cost) and accumulated depreciation is chosen the book value of the asset. When depreciation is recorded in an adjusting entry, Accumulated Depreciation is credited and Depreciation Expense is debited.

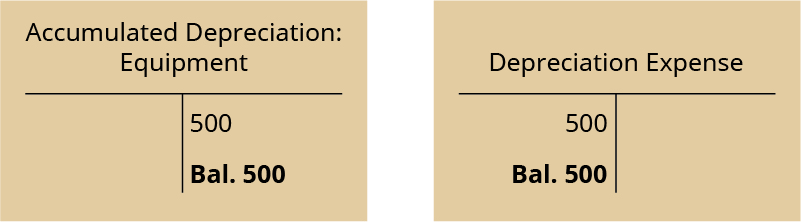

For example, permit'southward say a visitor pays ?ii,000 for equipment that is supposed to final four years. The company wants to depreciate the asset over those four years equally. This means the asset volition lose ?500 in value each year (?two,000/iv years). In the starting time year, the company would record the following adjusting entry to evidence depreciation of the equipment.

Depreciation Expense increases (debit) and Accumulated Depreciation, Equipment, increases (credit). If the company wanted to compute the book value, it would take the original cost of the equipment and subtract accumulated depreciation.

\(\text{Volume value of equipment}=?ii,000–?500=?1,500\)

This means that the electric current book value of the equipment is ?1,500, and depreciation will be subtracted from this figure the next year. The post-obit account balances after adjustment are as follows:

You will acquire more about depreciation and its ciphering in Long-Term Assets. All the same, one important fact that we need to address now is that the book value of an asset is not necessarily the price at which the nugget would sell. For example, y'all might have a building for which you paid ?ane,000,000 that currently has been depreciated to a book value of ?800,000. However, today it could sell for more than, less than, or the same as its volume value. The aforementioned is true about only nearly any nugget you tin name, except, perhaps, greenbacks itself.

Insurance policies tin require advanced payment of fees for several months at a time, vi months, for example. The visitor does not employ all six months of insurance immediately merely over the course of the half dozen months. At the stop of each calendar month, the company needs to record the amount of insurance expired during that month.

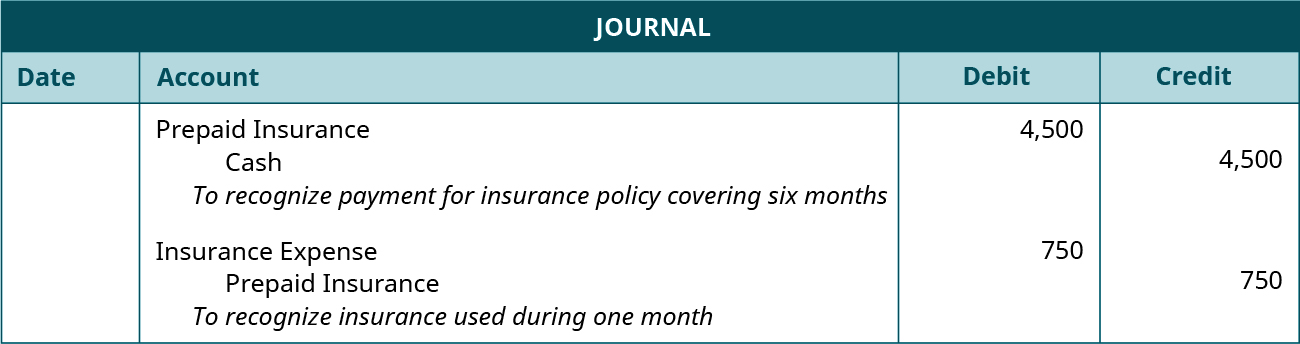

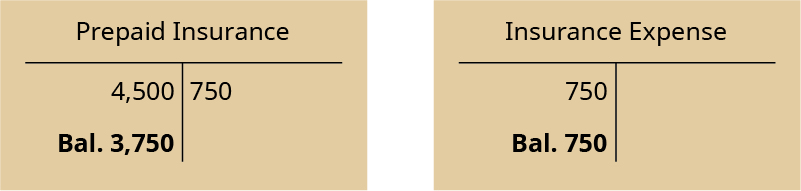

For example, a visitor pays ?four,500 for an insurance policy roofing half dozen months. It is the terminate of the get-go month and the company needs to record an adjusting entry to recognize the insurance used during the month. The following entries show the initial payment for the policy and the subsequent adjusting entry for ane month of insurance usage.

In the outset entry, Cash decreases (credit) and Prepaid Insurance increases (debit) for ?4,500. In the second entry, Prepaid Insurance decreases (credit) and Insurance Expense increases (debit) for one month'southward insurance usage found by taking the total ?4,500 and dividing past six months (4,500/6 = 750). The account balances after adjustment are equally follows:

Like to prepaid insurance, rent also requires advanced payment. Ordinarily to rent a space, a company volition need to pay rent at the beginning of the month. The company may also enter into a lease agreement that requires several months, or years, of rent in accelerate. Each month that passes, the company needs to record rent used for the month.

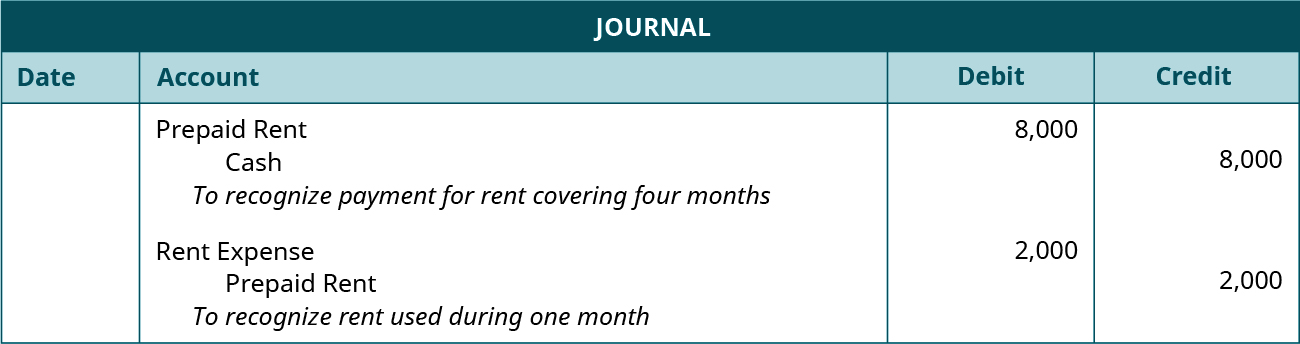

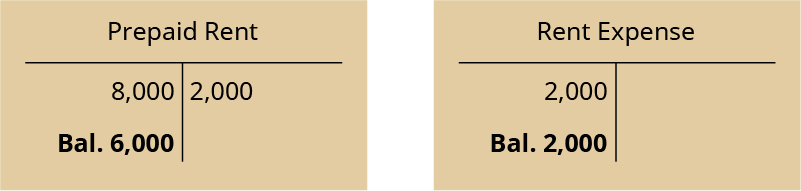

Let'due south say a company pays ?8,000 in advance for four months of hire. After the beginning month, the visitor records an adjusting entry for the rent used. The following entries prove initial payment for four months of rent and the adjusting entry for ane calendar month's usage.

In the commencement entry, Cash decreases (credit) and Prepaid Rent increases (debit) for ?viii,000. In the second entry, Prepaid Rent decreases (credit) and Hire Expense increases (debit) for 1 month's rent usage found by taking the total ?viii,000 and dividing by iv months (eight,000/four = two,000). The business relationship balances later on adjustment are equally follows:

Another type of deferral requiring adjustment is unearned revenue.

Unearned Revenues

Recall that unearned acquirement represents a customer'southward advanced payment for a product or service that has yet to be provided past the company. Since the company has non notwithstanding provided the product or service, it cannot recognize the client's payment as acquirement. At the end of a flow, the company will review the account to see if whatsoever of the unearned revenue has been earned. If so, this amount will be recorded as revenue in the current menses.

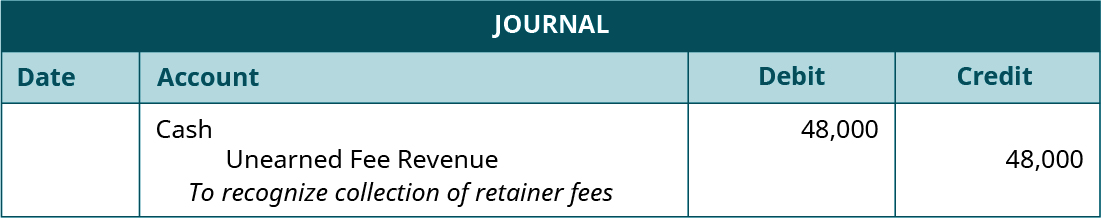

For instance, let'due south say the company is a law firm. During the twelvemonth, information technology collected retainer fees totaling ?48,000 from clients. Retainer fees are money lawyers collect in advance of starting work on a instance. When the company collects this money from its clients, it will debit cash and credit unearned fees. Even though not all of the ?48,000 was probably collected on the aforementioned twenty-four hours, we record it equally if it was for simplicity's sake.

In this instance, Unearned Fee Revenue increases (credit) and Greenbacks increases (debit) for ?48,000.

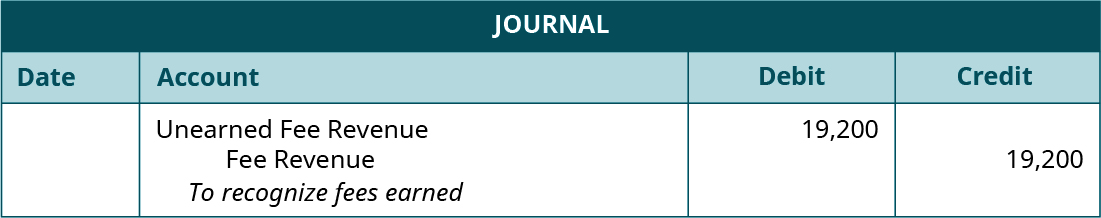

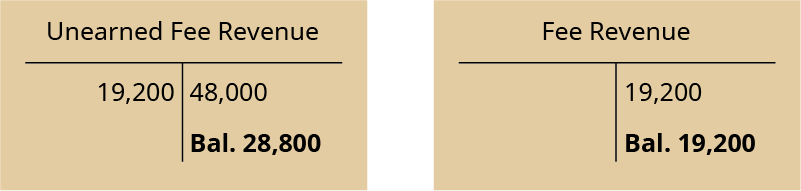

At the end of the year afterwards analyzing the unearned fees account, 40% of the unearned fees have been earned. This forty% can at present exist recorded as acquirement. Total revenue recorded is ?xix,200 (?48,000 × twoscore%).

For this entry, Unearned Fee Revenue decreases (debit) and Fee Revenue increases (credit) for ?19,200, which is the twoscore% earned during the yr. The company will have the post-obit balances in the two accounts:

Besides deferrals, other types of adjusting entries include accruals.

Accruals

Accruals are types of adjusting entries that accumulate during a menstruation, where amounts were previously unrecorded. The two specific types of adjustments are accrued revenues and accrued expenses.

Accrued Revenues

Accrued revenues are revenues earned in a catamenia but take nonetheless to be recorded, and no money has been collected. Some examples include interest, and services completed but a nib has nevertheless to be sent to the customer.

Involvement can be earned from banking concern account holdings, notes receivable, and some accounts receivables (depending on the contract). Involvement had been accumulating during the period and needs to exist adjusted to reflect involvement earned at the end of the menses. Annotation that this interest has non been paid at the end of the menstruation, only earned. This aligns with the revenue recognition principle to recognize acquirement when earned, even if cash has yet to be nerveless.

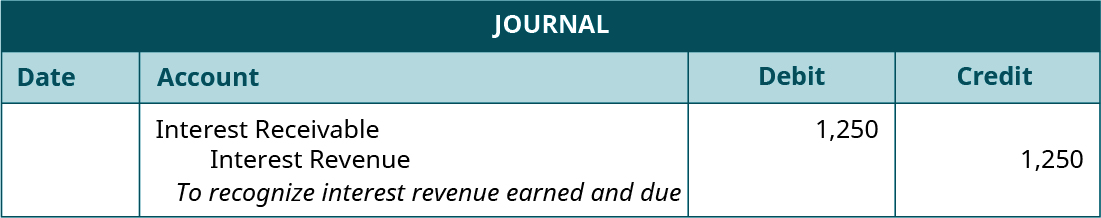

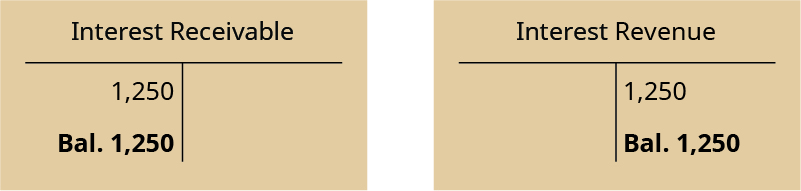

For case, assume that a company has 1 outstanding note receivable in the amount of ?100,000. Interest on this annotation is v% per yr. Three months have passed, and the company needs to record interest earned on this outstanding loan. The calculation for the interest acquirement earned is ?100,000 × 5% × three/12 = ?1,250. The following adjusting entry occurs.

Interest Receivable increases (debit) for ?1,250 because involvement has not nonetheless been paid. Interest Acquirement increases (credit) for ?1,250 considering interest was earned in the three-month period but had been previously unrecorded.

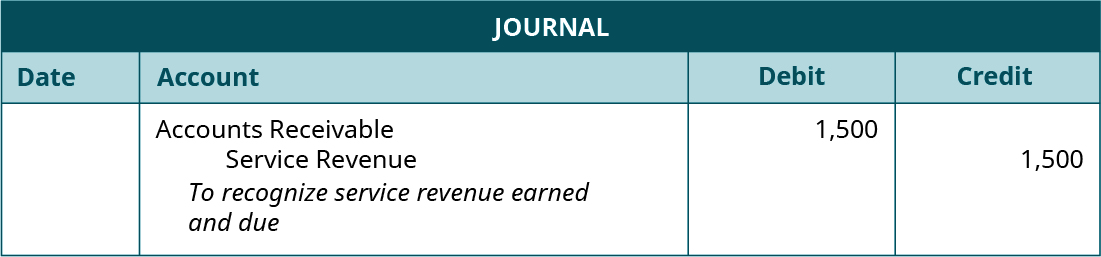

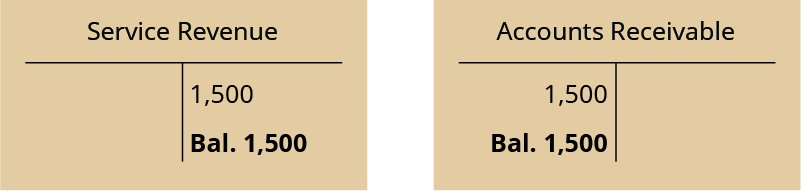

Previously unrecorded service revenue can arise when a visitor provides a service just did non yet bill the client for the work. This means the client has also not all the same paid for services. Since there was no bill to trigger a transaction, an adjustment is required to recognize revenue earned at the end of the period.

For example, a visitor performs landscaping services in the amount of ?1,500. Nevertheless, they have not yet received payment. At the flow end, the company would record the post-obit adjusting entry.

Accounts Receivable increases (debit) for ?1,500 because the customer has not yet paid for services completed. Service Revenue increases (credit) for ?1,500 because service revenue was earned but had been previously unrecorded.

Accrued Expenses

Accrued expenses are expenses incurred in a period but have however to be recorded, and no money has been paid. Some examples include involvement, tax, and bacon expenses.

Interest expense arises from notes payable and other loan agreements. The company has accumulated interest during the period but has not recorded or paid the corporeality. This creates a liability that the company must pay at a future engagement. You cover more details almost computing interest in Current Liabilities, and so for now amounts are given.

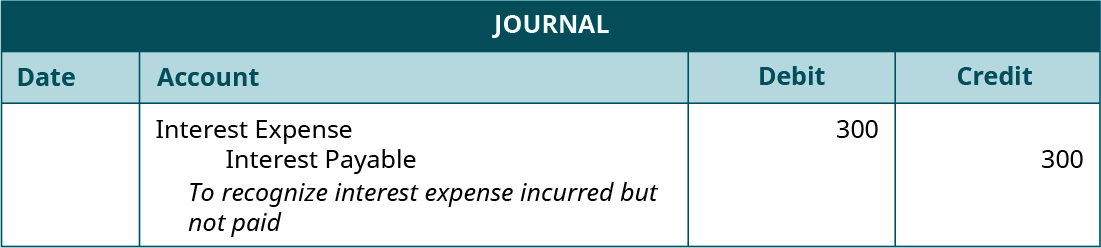

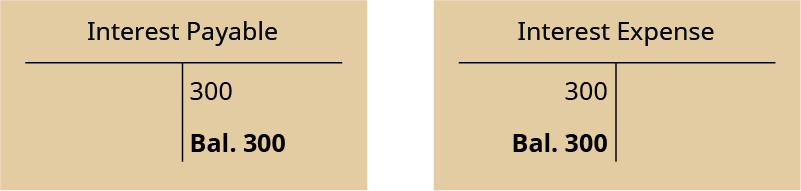

For instance, a company accrued ?300 of interest during the menstruum. The following entry occurs at the end of the period.

Interest Expense increases (debit) and Involvement Payable increases (credit) for ?300. The following are the updated ledger balances after posting the adjusting entry.

Taxes are only paid at certain times during the year, non necessarily every month. Taxes the company owes during a menstruation that are unpaid require adjustment at the stop of a menstruation. This creates a liability for the company. Some tax expense examples are income and sales taxes.

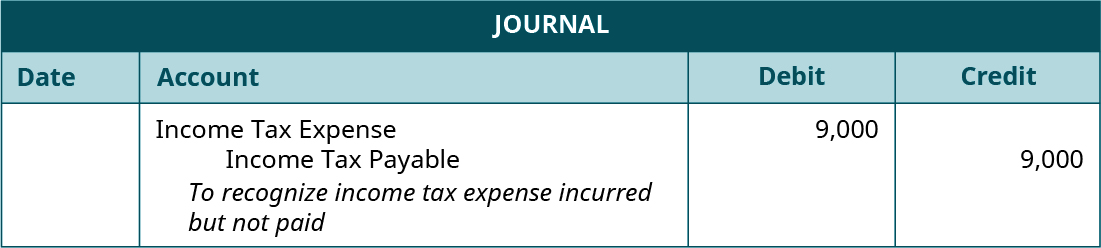

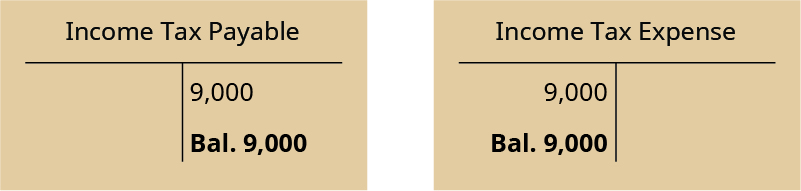

For example, a visitor has accrued income taxes for the month for ?ix,000. The company would record the post-obit adjusting entry.

Income Tax Expense increases (debit) and Income Tax Payable increases (credit) for ?9,000. The following are the updated ledger balances after posting the adjusting entry.

Many salaried employees are paid one time a calendar month. The salary the employee earned during the calendar month might non be paid until the following month. For example, the employee is paid for the prior calendar month's work on the first of the next month. The fiscal statements must remain up to date, so an adjusting entry is needed during the calendar month to show salaries previously unrecorded and unpaid at the finish of the month.

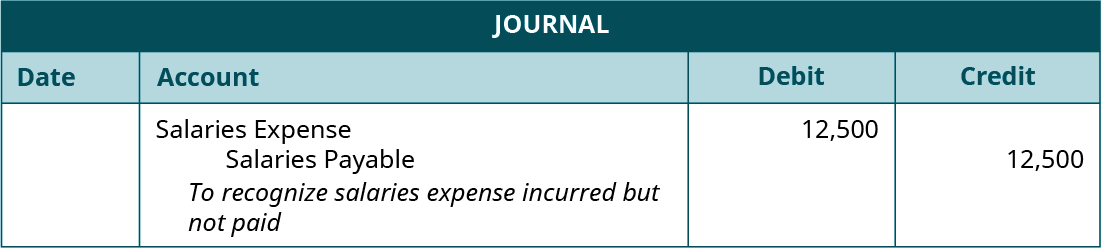

Allow's say a company has five salaried employees, each earning ?2,500 per calendar month. In our example, presume that they do non get paid for this work until the first of the side by side calendar month. The post-obit is the adjusting journal entry for salaries.

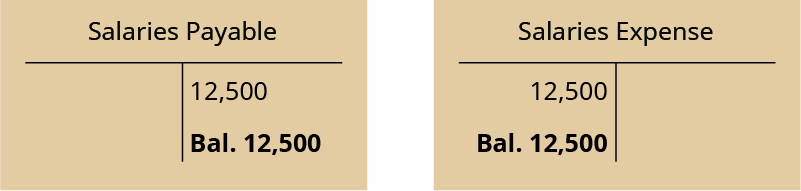

Salaries Expense increases (debit) and Salaries Payable increases (credit) for ?12,500 (?2,500 per employee × five employees). The post-obit are the updated ledger balances afterward posting the adjusting entry.

In Record and Mail service the Common Types of Adjusting Entries, nosotros explore some of these adjustments specifically for our company Press Plus, and show how these entries bear upon our full general ledger (T-accounts).

Adjusting Entries

| Example | Income Statement Business relationship | Balance Canvas Account | Cash in Entry? |

|---|---|---|---|

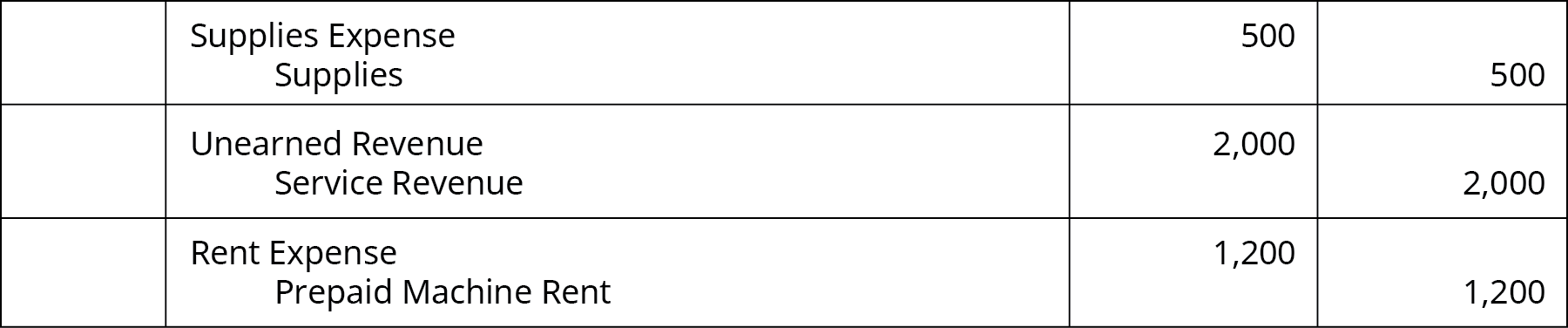

Review the three adjusting entries that follow. Using the tabular array provided, for each entry write down the income statement business relationship and balance canvas account used in the adjusting entry in the appropriate column. Then in the last column answer yep or no.

Solution

| Case | Income Statement Account | Residuum Sheet Account | Cash in Entry? |

|---|---|---|---|

| 1 | Supplies expense | Supplies | no |

| ii | Service Revenue | Unearned Acquirement | no |

| 3 | Rent Expense | Prepaid automobile rent | no |

Adjusting Entries Take Two

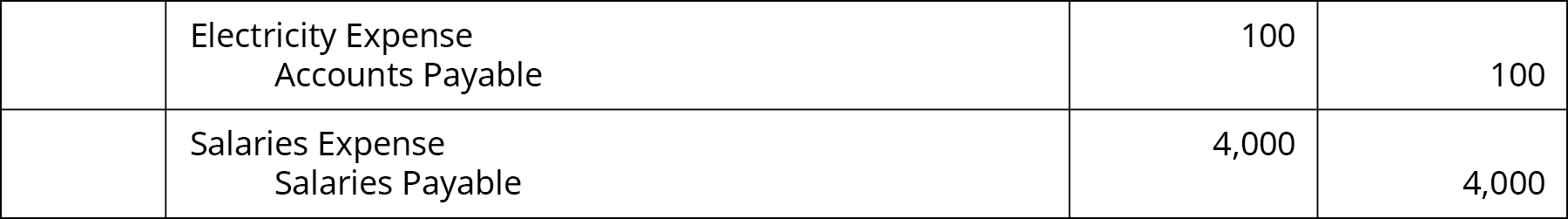

Did we continue to follow the rules of adjusting entries in these two examples? Explain.

| Example | Income Argument Account | Remainder Sheet Account | Cash in Entry? |

|---|---|---|---|

Solution

Yeah, we did. Each entry has one income statement account and one balance sail account, and greenbacks does not appear in either of the adjusting entries.

| Example | Income Statement Account | Balance Sheet Account | Greenbacks in Entry? |

|---|---|---|---|

| 1 | Electricity Expense | Accounts Payable | no |

| 2 | Salaries Expense | Salaries Payable | no |

Key Concepts and Summary

- Incorrect balances: Incorrect balances on the unadjusted trial balance occur because not every transaction produces an original source document that will alert the bookkeeper information technology is fourth dimension to brand an entry. It is not that the accountant made an error, it means an adjustment is required to correct the balance.

- Need for adjustments: Some account adjustments are needed to update records that may not have original source documents or those that exercise not reverberate change on a daily basis. The acquirement recognition principle, expense recognition principle, and time flow assumption all further the need for adjusting entries because they crave revenue and expense reporting occur when earned and incurred in a electric current period.

- Prepaid expenses: Prepaid expenses are assets paid for earlier their utilise. When they are used, this nugget'south value is reduced and an expense is recognized. Some examples include supplies, insurance, and depreciation.

- Unearned revenues: These are client advanced payments for product or services yet to be provided. When the company provides the production or service, revenue is and so recognized.

- Accrued revenues: Accrued revenues are revenues earned in a period only have even so to be recorded and no money has been nerveless. Accrued revenues are updated at the cease of the period to recognize revenue and money owed to the company.

- Accrued expenses: Accrued expenses are incurred in a period but have yet to exist recorded and no coin has been paid. Accrued expenses are updated to reflect the expense and the company'due south liability.

Multiple Selection

(Figure)Which type of adjustment occurs when greenbacks is either collected or paid, but the related income or expense is not reportable in the current period?

- accrual

- deferral

- estimate

- cull

(Figure)Which type of aligning occurs when cash is not nerveless or paid, simply the related income or expense is reportable in the current menstruation?

- accrual

- deferral

- approximate

- choose

A

(Effigy)If an adjustment includes an entry to a payable or receivable business relationship, which type of adjustment is it?

- accrual

- deferral

- gauge

- cull

(Figure)If an adjustment includes an entry to Accumulated Depreciation, which type of aligning is it?

- accrual

- deferral

- estimate

- cull

B

(Figure)Hire collected in advance is an example of which of the following?

- accrued expense

- accrued revenue

- deferred expense (prepaid expense)

- deferred revenue (unearned revenue)

(Figure)Hire paid in accelerate is an example of which of the post-obit?

- accrued expense

- accrued revenue

- deferred expense (prepaid expense)

- deferred revenue (unearned revenue)

C

(Effigy)Salaries owed but non yet paid is an example of which of the following?

- accrued expense

- accrued revenue

- deferred expense (prepaid expense)

- deferred revenue (unearned revenue)

(Effigy)Revenue earned simply non yet collected is an example of which of the following?

- accrued expense

- accrued revenue

- deferred expense (prepaid expense)

- deferred revenue (unearned revenue)

B

Questions

(Figure)What parts of the accounting bike require belittling processes, rather than methodical processes? Explain.

Analyzing transactions (to enable journal entries) is the only analytical office of the accounting cycle. Analysis is required for both the original transaction entries and the adjusting entries. All of the other steps are simply methodical posting of the entries, summarizing of the balances, regrouping of the accounts for financial reports, and closing of the accounts for yr-stop. Simply the journal entries require decision-making processes.

(Figure)Why is the adjusting procedure needed?

(Effigy)Proper noun two types of adjusting journal entries that are ordinarily made before preparing financial statements? Explain, with examples.

Accruals—when cash has not moved, but information technology is time to record the transaction (examples: Accounts Payable or Accounts Receivable). Deferrals—when greenbacks has moved, simply it is non time to record the transaction (examples: Prepaid Insurance or Unearned Revenue).

(Figure)Are there any accounts that would never accept an adjusting entry? Explicate.

(Effigy)Why do adjusting entries e'er include both balance sheet and income statement accounts?

Adjusting entries always include at least one income argument business relationship and at least ane balance canvas account, because the adjustment process is done to shift revenues and expenses between the Balance Sheet and the Income Argument, depending on whether it is the right menses to include that income or expense (report on the Income Argument) or not (study on the Balance Sheet).

(Figure)Why are adjusting journal entries needed?

Exercise Fix A

(Effigy)Identify which blazon of adjustment is indicated past these transactions. Choose accrued revenue, accrued expense, deferred revenue, or deferred expense.

- rent paid in advance for employ of property

- cash received in accelerate for time to come services

- supplies inventory purchased

- fees earned but not nevertheless nerveless

(Figure)The post-obit accounts were used to make twelvemonth-terminate adjustments. Place the related account that is associated with this account (the other account in the adjusting entry).

- Salaries Payable

- Depreciation Expense

- Supplies

- Unearned Rent

Exercise Set up B

(Figure)Place whether each of the post-obit transactions, which are related to acquirement recognition, are accrual, deferral, or neither.

- provided legal services to client, who paid at the fourth dimension of service

- received cash for legal services performed last month

- received greenbacks from clients for time to come services to be provided

- provided legal services to client, to be collected next month

(Figure)Identify whether each of the following transactions, which are related to expense recognition, are accrual, deferral, or neither.

- recorded employee salaries earned, to be paid in futurity month

- paid employees for electric current month salaries

- paid employee salaries for work performed in a prior month

- gave an employee an advance on future wages

(Figure)Indicate what impact the post-obit adjustments have on the accounting equation, Avails = Liabilities + Equity (assume normal balances).

| Impact 1 | Impact 2 | ||

|---|---|---|---|

| A. | Prepaid Insurance adjusted from ?5,000 to ?3,600 | ||

| B. | Involvement Payable adjusted from ?v,300 to ?6,800 | ||

| C. | Prepaid Insurance adjusted from ?18,500 to ?six,300 | ||

| D. | Supplies account residuum ?500, bodily count ?220 | ||

(Figure)What 2 accounts are affected by the needed adjusting entries?

- supplies bodily counts are lower than account residuum

- employee salaries are due but not paid at year end

- insurance premiums that were paid in advance have expired

Problem Set A

(Figure)Identify which type of aligning is indicated by these transactions. Choose accrued acquirement, accrued expense, deferred revenue, deferred expense, or estimate.

- utilities owed but not paid

- cash received in advance for futurity services

- supplies inventory purchased

- fees earned merely not still collected

- depreciation expense recorded

- insurance paid for future periods

(Figure)Identify which type of adjustment is associated with this account, and what is the other account in the aligning? Choose accrued acquirement, accrued expense, deferred acquirement, or deferred expense.

- accounts receivable

- involvement payable

- prepaid insurance

- unearned hire

(Effigy)Bespeak what touch on the following adjustments have on the accounting equation, Avails = Liabilities + Equity (presume normal balances).

| Impact ane | Touch ii | ||

|---|---|---|---|

| A. | Unearned Fees adapted from ?7,000 to ?5,000 | ||

| B. | Recorded depreciation expense of ?12,000 | ||

| C. | Prepaid Insurance adjusted from ?eighteen,500 to ?6,300 | ||

| D. | Supplies business relationship balance ?500, actual count ?220 | ||

(Effigy)What two accounts are affected by each of these adjustments?

- billed customers for services provided

- adjusted prepaid insurance to correct

- recorded depreciation expense

- recorded unpaid utility bill

- adjusted supplies inventory to correct

Problem Set B

(Effigy)Identify which blazon of adjustment is indicated by these transactions. Choose accrued acquirement, accrued expense, deferred acquirement, or deferred expense.

- fees earned and billed, but not collected

- recorded depreciation expense

- fees nerveless in advance of services

- salaries owed but not yet paid

- property rentals costs, prepaid for future months

- inventory purchased for cash

(Figure)Place which type of adjustment is associated with this business relationship, and what the other account is in the adjustment. Choose accrued revenue, accrued expense, deferred revenue, or deferred expense.

- Salaries Payable

- Interest Receivable

- Unearned Fee Revenue

- Prepaid Rent

(Effigy)Indicate what impact the following adjustments have on the bookkeeping equation: Avails = Liabilities + Disinterestedness (assume normal balances).

| Impact 1 | Impact 2 | ||

|---|---|---|---|

| A. | Unearned Hire adjusted from ?15,000 to ?9,500 | ||

| B. | Recorded salaries payable of ?iii,750 | ||

| C. | Prepaid Rent adjusted from ?6,000 to ?iv,000 | ||

| D. | Recorded depreciation expense of ?5,500 | ||

(Figure)What two accounts are afflicted by each of these adjustments?

- recorded accrued interest on annotation payable

- adjusted unearned rent to right

- recorded depreciation for the yr

- adjusted salaries payable to correct

- sold trade to customers on account

Idea Provokers

(Figure)Search the The states Securities and Exchange Commission website (https://www.sec.gov/edgar/searchedgar/companysearch.html), and locate the latest Class 10-K for a visitor you lot would like to analyze. Submit a brusk memo:

- Land the name and ticker symbol of the company you have chosen.

- Review the company'due south terminate-of-period Balance Sheet for the most recent annual study, in search of accruals and deferrals.

- Listing the proper name and account remainder of at least 4 accounts that represent accruals or deferrals—these could exist accrued revenues, accrued expenses, deferred (unearned) revenues, or deferred (prepaid) expenses.

- Provide the web link to the company's Form 10-K, to allow accurate verification of your answers.

Glossary

- accrual

- type of adjusting entry that accumulates during a menses, where an amount was previously unrecorded

- accrued expense

- expense incurred in a period but not yet recorded, and no coin has been paid

- accrued revenue

- revenue earned in a period but not all the same recorded, and no coin has been nerveless

- adjusting entries

- update bookkeeping records at the finish of a period for any transactions that have not yet been recorded

- book value

- departure between the nugget's value (cost) and accumulated depreciation; besides, value at which assets or liabilities are recorded in a visitor'southward financial statements

- contra account

- account paired with another business relationship type that has an opposite normal residual to the paired business relationship; reduces or increases the balance in the paired account at the end of a period

- deferral

- prepaid expense and revenue accounts that have delayed recognition until they accept been used or earned

- useful life

- time period over which an asset cost is allocated

alexanderburperear.blogspot.com

Source: https://opentextbc.ca/principlesofaccountingv1openstax/chapter/discuss-the-adjustment-process-and-illustrate-common-types-of-adjusting-entries/

0 Response to "Accrual Basis Accounting Requires the Business to Review the Unadjusted Trial Balance"

Post a Comment